financial wellness

More Americans Joining Workforce, But Many Are Unable to Find Living-Wage Jobs

Last Updated on September 19, 2025 by Daily News Staff

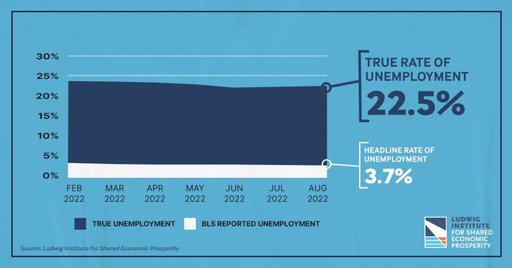

WASHINGTON, Sept. 15, 2022 /PRNewswire/ — The American workforce expanded from July to August, but many of those workers found they were unable to secure Living-Wage Jobs, according to an analysis by the Ludwig Institute for Shared Economic Prosperity (LISEP).

In its monthly True Rate of Unemployment (TRU) for August, LISEP reported that 22.5% of American workers are now classified as “functionally unemployed,” defined as the jobless, plus those seeking but unable to secure full-time employment, even if they want to work full-time and/or cannot earn above the poverty line after adjusting for inflation. This is an increase of 0.2 percentage points over the July TRU.

TRU’s sister metric, TRU Out of the Population (TRU OOP) – a measure of those who are functionally unemployed out of the entire population, not just active workforce participants – remained unchanged, which, when coupled with a rising TRU, indicates more workers are joining or returning to the labor force.

“It is a net positive that previously discouraged workers are rejoining the workforce, but unfortunately, their return to the workforce is, in many cases, not a return to full-time, living-wage employment,” said LISEP founder and chair Gene Ludwig. “The challenge for policymakers is to continue to encourage positive growth in employment opportunities, but do so in a manner that provides for growth in living-wage jobs for every American who wants one.”

Demographically, Black workers saw the biggest jump in TRU, increasing by 0.6 percentage points, from 25.8% to 26.4%. This, with the Black TRU OOP climbing by 0.7 percentage points, indicates that a larger percentage of Black workers are classified as functionally unemployed. Hispanic workers saw no change in the TRU, holding steady at 26.3%, with White workers tracking the overall TRU and increasing by 0.2 percentage points, to 20.7%. Male TRU increased a full percentage point, from 17.5% to 18.5%, while women dropped a half percentage point, from 27.5% to 27.0%.

Living-wage job opportunities continue to be an issue for workers with only a high school diploma, with the TRU for this group jumping 2.5 percentage points, from 24.5% to 27.0%. Likewise, those without a high school degree saw their TRU increase, from 47.3% to 47.6%. TRU for workers with some college (but no college degree) dropped, from 25.6% to 23.7%, but an analysis of the TRU OOP for this group indicates the decline is likely due to discouraged workers in this cohort leaving the workforce.

“We know the cost of living continues to be an issue for low- and middle-income Americans, as inflation continues to erode the ability of these workers to maintain even a basic standard of living. So in that respect, I’m somewhat relieved there wasn’t a bigger increase in the overall TRU,” Ludwig said. “But at the same time, we are witnessing an alarming decline in the opportunities for some minority workers to earn a living wage, which is undoubtedly a reason for concern. The bottom line: we can do better.”

About TRU

LISEP issued the white paper “Measuring Better: Development of ‘True Rate of Unemployment’ Data as the Basis for Social and Economic Policy” upon announcing the new statistical measure in October 2020. The paper and methodology can be viewed here. LISEP issues TRU one to two weeks following the release of the BLS unemployment report, which occurs on the first Friday of each month. The TRU rate and supporting data are available on the LISEP website at https://www.lisep.org/tru.

About LISEP

The Ludwig Institute for Shared Economic Prosperity (LISEP) was created in 2019 by Ludwig and his wife, Dr. Carol Ludwig. The mission of LISEP is to improve the economic well-being of middle- and lower-income Americans through research and education. LISEP’s original economic research includes new indicators for unemployment, earnings, and cost of living. These metrics aim to provide policymakers and the public with a more transparent view of the economic situation of all Americans, particularly low- and middle-income households, compared with misleading headline statistics.

About Gene Ludwig

In addition to his role as LISEP chair, Gene Ludwig is founder of the Promontory family of companies and Canapi LLC, a financial technology venture fund. He is the founder and CEO of Ludwig Regulatory Group (LRG), which advises financial firms on critical matters. Ludwig is the former vice chairman and senior control officer of Bankers Trust New York Corp. and served as the U.S. Comptroller of the Currency from 1993 to 1998. He is also author of the book The Vanishing American Dream, which investigates the economic challenges facing low- and middle-income Americans. On Twitter: @geneludwig.

SOURCE Ludwig Institute for Shared Economic Prosperity

Discover more from Daily News

Subscribe to get the latest posts sent to your email.

Lifestyle

Preparing Students for What’s Next in Work

Preparing Students: Automation, AI and societal economic changes are affecting the workforce and making a significant impact on the employment prospects of future generations. Consider this guidance to put students on the path toward greater earning potential and economic mobility in a rapidly changing economy.

Preparing Students for What’s Next in Work

(Family Features) Automation, AI and societal economic changes are affecting the workforce and making a significant impact on the employment prospects of future generations. More than one-third of today’s college graduates are “underemployed,” meaning they work jobs that don’t require a college degree and may pay less than a living wage, according to data from the Federal Reserve Bank of New York. At the same time, a World Economic Forum report explored how advances in AI are threatening to negatively impact access to entry-level and even mid-level jobs for millions of Americans. Looking ahead, research by Georgetown University indicates that by 2031, 70% of jobs will require education or training beyond high school. However, data from the National Center for Education Statistics indicate only one-third of high school graduates go on to complete a college degree with many of those being in fields that are not in high-earning, high-growth professions. These challenges are not lost on today’s students. In a survey by Junior Achievement and Citizens, 57% of teens reported AI has negatively impacted their career outlook, raising concerns about job replacement and the need for new skills. What’s more, a strong majority (87%) expect to earn extra income through side hustles, gig work or social media content creation. “To put students on the path toward greater earning potential and economic mobility in a rapidly changing economy, students need proactive education and exposure to transferable skills and competencies, such as creative and critical thinking, financial literacy, problem-solving, collaboration and career planning,” said Jack Harris, CEO, Junior Achievement. This assertion is consistent with findings from the Camber Collective. This social impact consulting group identified four key life experiences students can consider and explore that positively affect lifetime earnings, including:- Completing secondary education

- Graduating with a degree in a high-paying field of study

- Receiving mentorship during adolescence

- Obtaining a first full-time job with opportunity for advancement

- Learning opportunities that are designed with the future in mind. For example, learning experiences offered through Junior Achievement reflect the skills and competencies needed to promote economic mobility.

- Internships or apprenticeships that provide hands-on experience and exposure to a career field that can’t be found in a textbook.

- Volunteer or extracurricular roles that develop communication and leadership skills. Virtually every career field requires these soft skills for growth and greater earning potential.

- Relationships that provide insight and connection. Networking with individuals who are already excelling in a chosen field, as well as peers who share similar aspirations, offers perspective from those who are where you wish to be and potentially opens future doors for employment.

- Courses that offer introductory insight into a chosen career path. Local trade or technical schools and other training organizations may even offer certifications that align with a student’s area of interest.

Discover more from Daily News

Subscribe to get the latest posts sent to your email.

home improvement

5 Ways to Trim Home Energy Bills

Last Updated on January 4, 2026 by Daily News Staff

(Family Features) After the mortgage, utility costs, including electricity, likely make up one of the most significant portions of monthly budgets for the typical American household. In fact, according to data from the U.S. Energy Information Administration, the average residential electric bill in the United States is $143.

However, reducing your family’s energy costs is possible by following some smart, practical, cost-cutting tips from the heating and cooling experts at Mitsubishi Electric. Consider these ways to help dial down your energy bills.

Service HVAC Systems Regularly

To ensure the best performance and efficiency possible, find a licensed contractor to keep your heating and cooling system well-maintained and serviced throughout the year. There are some tasks many homeowners can handle on their own, like keeping outdoor units free of debris and changing air filters. Some filters are removable and washable, saving you money. However, bringing in a professional 1-2 times a year for maintenance and to ensure proper function of ductwork and electrical components is also essential.

Use Appliances During Non-Peak Hours

Rather than using stoves, ovens and clothing dryers in the afternoon hours, consider doing so early in the morning or late in the evening. Peak time for many electricity providers is noon-6 p.m., meaning using these appliances outside of this timeframe when conventional heating and cooling systems are likely running full throttle can help lower energy costs.

Upgrade Your System

The Inflation Reduction Act (IRA) incentivizes homeowners that opt for energy-efficient air-conditioning and heating options to replace fossil-fuel-fired furnaces. This includes upgrading your existing HVAC system to a qualified heat pump. For example, Mitsubishi Electric heat pumps provide more energy-efficient cooling and heating that equals cost and energy savings as well as a reduced carbon footprint for homeowners.

Installing a smart electrical panel alongside an all-electric heat pump enables homeowners to monitor and control energy consumption on-site or remotely using a smartphone for better overall efficiency and utility cost savings.

Harness the Sun’s Energy with Solar Panels

According to the Office of Energy Efficiency & Renewable Energy, the amount of sunlight that strikes the Earth’s surface in 90 minutes could power the world’s total energy usage for a full year. Investing in solar panels can help decrease energy bills and increase your home’s sustainability. Additionally, some utility providers and government entities, including the IRA, offer incentives to help reduce installation costs.

Avoid Heating or Cooling Unused Spaces

One mistake many homeowners make is forgetting to adjust their temperature settings when leaving the house. Whether you’re headed out for the weekend or just headed to work for the day, running your system in an empty house can result in unnecessarily high utility bills.

Multi-zone, all-electric heat pumps like those from Mitsubishi Electric allow homeowners to set the comfort level and adjust the temperature in each room, reducing the energy waste of cooling unoccupied rooms. With a smartphone app, you can even adjust the settings remotely.

Find more ways to increase energy savings while making your home more sustainable by visiting MitsubishiComfort.com.

Photo courtesy of Getty Images

SOURCE:

Mitsubishi Electric

Discover more from Daily News

Subscribe to get the latest posts sent to your email.

Business and Finance

Make Your Job Work for You

Last Updated on December 31, 2025 by Daily News Staff

Make Your Job Work for You

(Family Features) For some people, job dissatisfaction is the result of a crummy boss or stifling work environment. For others, the problem lies much deeper; it’s a need to reevaluate your career path and find a more suitable fit.

If you’re considering a career change but not sure which direction you’re headed, consider these words of wisdom:

Do some self-reflecting. Take time to give your current work situation a thorough analysis. Determine which elements you enjoy, what rubs you the wrong way and what you’d change if you could. Think about practical solutions to the problems you identify whether it’s changing to a different role in the same field or exploring a new industry entirely. Avoid the temptation to focus on the negative. Rather, take plenty of time to consider the positive aspects of your current job, since that insight can help inform your next step. For example, if you enjoy the limited contact you have with customers, a job with more customer-facing interaction might not be a good fit.

Ask for input. Sometimes loved ones hold the key to a happier career path because they can point out details you don’t recognize. They might recall a time when you were most relaxed and happy, or they might point out talents or skills you take for granted. Often, these natural abilities are an excellent foundation for a career because you’re well-equipped to be successful.

Consider your personal interests. Keeping your personal life and professional life separate isn’t necessarily a bad idea but finding a way to merge the two can be useful. This is especially true if you’re able to combine training or skills with something you’re passionate about. For example, if you’re an avid outdoorsman, you might find great satisfaction in applying your business management background to work for a company that specializes in camping gear.

Understand what motivates you. Landing in the right job isn’t just about having the right qualifications for a position that interests you. At the end of the day, you’ll feel most content when your job offers meaningful rewards. Motivators can be financial, or they might have more to do with the ability to learn and grow. Some people are willing to sacrifice a bigger paycheck to know they’re making a meaningful contribution in a field they care about. Knowing what outcomes resonate best can help you find a more rewarding career.

Do your research. Changing your career path is a big move, and one you shouldn’t take lightly. Before diving in, spend time looking into the field you’re considering so you have a better sense of factors like growth opportunities, job availability, qualifications, compensation and more. If you find you aren’t quite qualified for the job you think you want, explore what it will take to get there whether it’s training, education or putting in your time to gain experience and work your way into the role you desire.

A career change may be just what you need to shift your life in the direction you want. Find more career advice at eLivingtoday.com.

Photo courtesy of Unsplash

SOURCE:

Family Features

Discover more from Daily News

Subscribe to get the latest posts sent to your email.