financial wellness

Informal safety nets help many Americans with expenses – people at all income levels benefit from this ‘financial interdependence’

Many Americans engage in informal financial support networks, reflecting cultural traditions and economic needs, which are becoming increasingly vital amid rising living costs and economic pressures.

Jeffrey Anvari-Clark, University of North Dakota

About 1 in 5 American adults regularly provide unpaid care or financial assistance to their adult relatives or friends. And about 1 in 7 young adults between the ages of 25 and 34 live with their parents.

But the true extent of support among Americans is deeper and broader.

From parents covering the cost of unexpected car repairs to colleagues raising funds for their co-workers’ medical expenses, Americans help each other in countless ways.

As a social work scholar who researches these patterns of what I call “financial interdependence,” I often observe transactions that challenge a common American narrative that most people in this country are handling their expenses on their own.

A long-standing tradition

The practice of sharing money with your friends and loved ones has deep roots in American society. Many Native American communities have traditions of sharing food and other resources with one another.

In the 19th century, mutual aid societies formed everywhere from Philadelphia to Florida. Many of them helped free Black people weather economic hardships. These organizations provided everything from unemployment assistance to burial expenses.

Today’s informal support networks echo these historical patterns.

In particular, many immigrant communities maintain traditional practices of collectively saving and lending money. Mexican American families often participate in “tandas,” which pool their savings to achieve financial goals or meet urgent needs. Similarly, West African and Caribbean communities in the U.S. organize “susu” groups, while many Chinese American communities form “hui” associations.

Local “hometown associations” additionally often offer both financial and social support to their members – aiding immigrant communities in the U.S. and people back in their homelands.

Everyone does it

These mutual support arrangements are very widespread and operate across all income levels, though they take different forms. They can be secular or religious. The true extent of this kind of activity is generally unknown.

Lower-income families often engage in frequent, smaller exchanges. They might share grocery costs, for example, or relatives may help one another out with the payment of large, unexpected bills.

Wealthier Americans tend to give larger amounts of money to extended family members, but less often. These might include a parent’s help with a down payment on a young adult’s first house or paying a portion of the cost of a grandchild’s college education.

Some families establish formal structures such as financial trusts or 529 educational savings accounts to make these transfers easier to complete and track. The number of people using 529 accounts has been increasing steadily, as states offer matching funds and tax incentives.

The nature of this financial support often reflects economic needs and cultural values. In many East Asian American communities, for example, adult children routinely provide financial support to their parents – as a cultural expectation.

Regardless of the community involved, technology has transformed how people share money with their friends and family.

Mobile payment platforms make it easier to split costs and send quick assistance. Money-transfer apps have normalized small-scale financial sharing among friends and family.

Online and social media platforms are used to gather resources for medical expenses, funerals or emergency needs. These tools extend traditional support networks beyond geographic boundaries.

Other kinds of support

Financial assistance can extend far beyond direct monetary help.

Families and communities might purchase bulk grocery items together to save money, or live together to manage rising housing costs. Some parents create informal child care cooperatives, while others coordinate care responsibilities for aging relatives with their extended families.

Financial education often emphasizes individual savings and budgeting. Yet, many Americans practice financial interdependence by managing their finances and making decisions in collaboration with others.

Addressing challenges

To meet today’s economic challenges, Americans are finding creative solutions through shared resources.

Young adults increasingly need more help to become homeowners than what they can get from a bank. The median home price has far outpaced wage growth, making family assistance crucial for many first-time buyers.

College costs have stabilized, albeit at high levels, leading more families to pool resources for educational support. This often creates long-term financial obligations across generations.

Medical expenses remain a leading cause of financial strain, pushing families to rely on each other to pay for health-related costs.

These support systems work at many levels, including family, community, the workplace and in government.

Some employers now offer emergency loan programs and matching funds for employee hardship. Some businesses create formal peer support systems for employees facing financial challenges.

A few states are also supporting family caregivers by providing tax credits to reimburse their out-of-pocket expenses.

Recognizing the financial burden of caregiving, Michigan Gov. Gretchen Whitmer has proposed a tax credit to support dependent respite services, nursing and transportation.

Some complications

While financial interdependence provides crucial assistance, it can also create challenges.

Financial responsibilities can strain family and friendship bonds. The provision of too much financial help can create or reinforce power imbalances within relationships. Some communities may not have enough money to be able to equally and effectively assist all members.

Clear communication and healthy boundaries can help manage these tensions.

As economic pressures mount for many American families, these informal financial support networks are growing more vital. Studies show that rising costs make financial stability increasingly difficult to achieve on your own.

Jeffrey Anvari-Clark, Assistant Professor of Social Work, University of North Dakota

This article is republished from The Conversation under a Creative Commons license. Read the original article.

STM Daily News is a vibrant news blog dedicated to sharing the brighter side of human experiences. Emphasizing positive, uplifting stories, the site focuses on delivering inspiring, informative, and well-researched content. With a commitment to accurate, fair, and responsible journalism, STM Daily News aims to foster a community of readers passionate about positive change and engaged in meaningful conversations. Join the movement and explore stories that celebrate the positive impacts shaping our world.

Discover more from Daily News

Subscribe to get the latest posts sent to your email.

Family

Holiday Must-Haves: Make holiday shopping a cinch

There’s nothing quite like the joy of watching a loved one’s face light up when opening a gift you selected with care, but holiday shopping can be a chore.

Last Updated on November 28, 2025 by Daily News Staff

(Family Features) There’s nothing quite like the joy of watching a loved one’s face light up when opening a gift you selected with care, but holiday shopping can be a chore.

If you’re a shopper at heart, it may be a challenge you enjoy, but if the idea of holiday shopping brings out the Grinch in you, consider these ideas for gifts to delight those you love this holiday season.

Look for more ideas to make this holiday season magical at eLivingtoday.com.

Power Up Your Holidays with Protein

Whether you’re out shopping or traveling for the holiday, savor the season without compromising health goals by treating yourself to a Premier Protein Winter Mint Chocolate High Protein Shake. Featuring cozy chocolate and refreshing mint flavors, this seasonal favorite is back, but for a limited time only. Flavorful and packed with the nutrition you need, each shake includes 30 grams of protein, 160 calories and 1 gram of sugar. Whether you drink this shake on its own or use it as an ingredient, you can ring in the season with a healthy amount of vitamins C and E, important antioxidants to support a healthy immune system as part of a healthy diet and lifestyle. Learn more at PremierProtein.com.

Holiday Sweets for a Good Cause

Few things go together like the holiday season and sweet treats. By gifting family and friends Wendy’s Frosty Key Tags, which are good for a free Jr. Frosty with every purchase, you can give back all year long because proceeds from every tag sold helps the Dave Thomas Foundation for Adoption find loving, adoptive homes for children in foster care. Available for purchase every November and December, tags are good for one full year and can be purchased in-restaurant, at the drive-thru, via a kiosk, through the app or at Wendys.com.

Step Up Gifting with Fashion-Forward Footwear

Every fashionista knows there’s no such thing as too many shoes, and that includes ankle boots and booties that never go out of style. These low-slung styles can be dressed up or down, depending on the look you’re wearing. Among this season’s hottest designs are faux animal prints, such as cheetah or snakeskin, that add some playful color and texture to complete an ensemble. If you’re not sure about the color or style, a classic black or brown bootie with well-padded soles and a moderate heel is a versatile choice with universal appeal.

Brrr-ing Gifts of Warmth and Good Cheer

Give loved ones an easy way to brighten a cold, dreary day with a cute and cozy matching hat and glove set. It’s a thoughtful and practical gift that brings a smile to recipients’ faces each time they don those warm layers to face a blustery day. What’s more, with all the options for personalization, it’s an affordable way to show you care. When choosing the perfect duo, keep your loved ones’ tastes and preferences in mind. You can find hats and gloves to match virtually any interest, whether it’s a favorite color, sports team or pop culture reference.

Holiday Shopping Hot List

Turns out, Santa may be onto something. Making your list and checking it twice can help you save money (and your sanity) during the holiday season.

- Set a budget and stick to it. Remember to include all your seasonal expenses, including Secret Santa and teacher gifts, ingredients for dishes you’ll take to potluck gatherings and admission to special holiday activities.

- Make a list. Having an idea of what you’d like to buy can help you stick to your budget and avoid frustration when you’re in the stores. You’ll be more likely to avoid costly impulse purchases and you’ll be more efficient while shopping. If you can, jot down a couple of backup ideas just in case what you want proves hard to find or exceeds your budget.

- Shop for deals. Before you head out shopping, research specials on the items on your list. You may be able to adjust your timing to take advantage of sales or find steep discounts at stores you don’t normally visit.

- Give yourself plenty of time. If holiday shopping stresses you out, it’s a good idea to start early. That way you can tackle a little at a time and avoid feeling the pressure of a ticking clock. Also try shopping during off-peak hours, such as during the week, when stores are likely to be less crowded.

- Map out your plan of attack. Planning the most direct route to travel from one retailer to the next can help keep you organized and avoid unnecessary backtracking. You can also save time and gas by making purchases online. Be sure to watch for promotions that provide free shipping and be conscious of shipping times to ensure gifts arrive in time for the big day.

Photo courtesy of Getty Images (couple with gifts)

Photos courtesy of Unsplash (boots and hats)

SOURCE:

Premier Protein

Wendy’s

Discover more from Daily News

Subscribe to get the latest posts sent to your email.

Family

Holiday Must-Haves: Make holiday shopping a cinch

There’s nothing quite like the joy of watching a loved one’s face light up when opening a gift you selected with care, but holiday shopping can be a chore.

Last Updated on November 26, 2025 by Daily News Staff

(Family Features) There’s nothing quite like the joy of watching a loved one’s face light up when opening a gift you selected with care, but holiday shopping can be a chore.

If you’re a shopper at heart, it may be a challenge you enjoy, but if the idea of holiday shopping brings out the Grinch in you, consider these ideas for gifts to delight those you love this holiday season.

Look for more ideas to make this holiday season magical at eLivingtoday.com.

Power Up Your Holidays with Protein

Whether you’re out shopping or traveling for the holiday, savor the season without compromising health goals by treating yourself to a Premier Protein Winter Mint Chocolate High Protein Shake. Featuring cozy chocolate and refreshing mint flavors, this seasonal favorite is back, but for a limited time only. Flavorful and packed with the nutrition you need, each shake includes 30 grams of protein, 160 calories and 1 gram of sugar. Whether you drink this shake on its own or use it as an ingredient, you can ring in the season with a healthy amount of vitamins C and E, important antioxidants to support a healthy immune system as part of a healthy diet and lifestyle. Learn more at PremierProtein.com.

Holiday Sweets for a Good Cause

Few things go together like the holiday season and sweet treats. By gifting family and friends Wendy’s Frosty Key Tags, which are good for a free Jr. Frosty with every purchase, you can give back all year long because proceeds from every tag sold helps the Dave Thomas Foundation for Adoption find loving, adoptive homes for children in foster care. Available for purchase every November and December, tags are good for one full year and can be purchased in-restaurant, at the drive-thru, via a kiosk, through the app or at Wendys.com.

Step Up Gifting with Fashion-Forward Footwear

Every fashionista knows there’s no such thing as too many shoes, and that includes ankle boots and booties that never go out of style. These low-slung styles can be dressed up or down, depending on the look you’re wearing. Among this season’s hottest designs are faux animal prints, such as cheetah or snakeskin, that add some playful color and texture to complete an ensemble. If you’re not sure about the color or style, a classic black or brown bootie with well-padded soles and a moderate heel is a versatile choice with universal appeal.

Brrr-ing Gifts of Warmth and Good Cheer

Give loved ones an easy way to brighten a cold, dreary day with a cute and cozy matching hat and glove set. It’s a thoughtful and practical gift that brings a smile to recipients’ faces each time they don those warm layers to face a blustery day. What’s more, with all the options for personalization, it’s an affordable way to show you care. When choosing the perfect duo, keep your loved ones’ tastes and preferences in mind. You can find hats and gloves to match virtually any interest, whether it’s a favorite color, sports team or pop culture reference.

Holiday Shopping Hot List

Turns out, Santa may be onto something. Making your list and checking it twice can help you save money (and your sanity) during the holiday season.

- Set a budget and stick to it. Remember to include all your seasonal expenses, including Secret Santa and teacher gifts, ingredients for dishes you’ll take to potluck gatherings and admission to special holiday activities.

- Make a list. Having an idea of what you’d like to buy can help you stick to your budget and avoid frustration when you’re in the stores. You’ll be more likely to avoid costly impulse purchases and you’ll be more efficient while shopping. If you can, jot down a couple of backup ideas just in case what you want proves hard to find or exceeds your budget.

- Shop for deals. Before you head out shopping, research specials on the items on your list. You may be able to adjust your timing to take advantage of sales or find steep discounts at stores you don’t normally visit.

- Give yourself plenty of time. If holiday shopping stresses you out, it’s a good idea to start early. That way you can tackle a little at a time and avoid feeling the pressure of a ticking clock. Also try shopping during off-peak hours, such as during the week, when stores are likely to be less crowded.

- Map out your plan of attack. Planning the most direct route to travel from one retailer to the next can help keep you organized and avoid unnecessary backtracking. You can also save time and gas by making purchases online. Be sure to watch for promotions that provide free shipping and be conscious of shipping times to ensure gifts arrive in time for the big day.

Photo courtesy of Getty Images (couple with gifts)

Photos courtesy of Unsplash (boots and hats)

SOURCE:

Premier Protein

Wendy’s

Discover more from Daily News

Subscribe to get the latest posts sent to your email.

Consumer Corner

Black Friday Redefined: A month-long ritual of planning, patience and price-checking

Last Updated on November 21, 2025 by Daily News Staff

(Family Features) Once a one-day shopping extravaganza defined by long lines and doorbuster deals, Black Friday has transformed into a season of rolling discounts and fading excitement.

Black Friday Redefined: A month-long ritual of planning, patience and price-checking

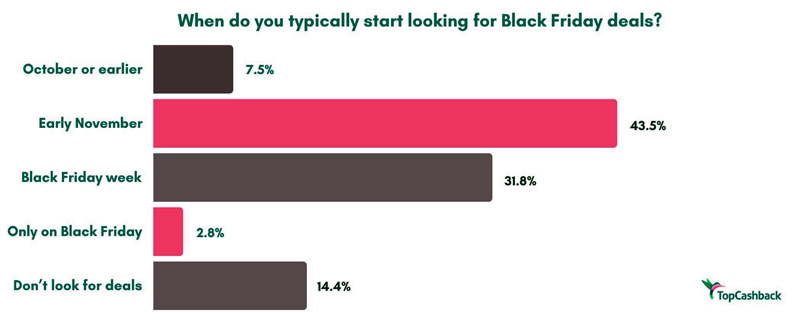

According to new research from TopCashback, nearly 7 in 10 Americans no longer consider Black Friday a one-day event, viewing it instead as a month-long shopping season. Only about one-third still see it as a single-day tradition. More than half of respondents said they now shop online instead of in stores, and 43% start scouting deals in early November.

Findings suggest Black Friday’s sense of urgency has shifted, replaced by a steady flow of rolling discounts and digital promotions. What was once a race for the best bargains has become a marathon for savings.

The evolution of Black Friday appears to be changing how people spend, too. While 18% of shoppers said they spend less now than they did five years ago, another 18% said their habits haven’t changed much. Only 3% reported spending more. For many, the shift seems to be less about budget and more about timing.

Asked whether they’d prefer Black Friday return to a single-day event, 44% said they like having more time to shop, while 26% said a one-day version would feel “less overwhelming.” The rest simply don’t mind either way.

“Consumers are rethinking how they approach major sales events,” said Destiny Chatman, consumer analyst at TopCashback. “They still want value, but they’re less willing to be rushed. The new Black Friday is about planning, timing and feeling in control of spending.”

The research also found shoppers are increasingly aware of the marketing tactics behind the hype. Two-thirds said they believe brands create fake urgency around Black Friday, and another 30% said they think it happens “sometimes.” Despite the skepticism, most still admit deep discounts drive their decisions – nearly 87% said upfront savings are their top motivator, compared with just 6% who said they’re most influenced by cash back or rewards.

Still, money-back incentives aren’t without impact. Four in 10 respondents said they’ve made a purchase specifically because cash back was offered, and about half said they’d consider choosing a smaller discount if it came with meaningful rewards. Electronics and tech ranked as the top categories where shoppers expect to earn the most cash back, followed by fashion and beauty.

Even with the season stretching longer, the emotional rollercoaster of Black Friday remains. Most respondents said they feel neutral after shopping while 33% said they feel proud of the deals they scored. Smaller groups reported guilt or regret after their purchases.

Impulse buying persists with more than 62% saying they occasionally buy things they didn’t plan to, and nearly 1 in 5 said it happens most years. Still, only 5% said they always feel pressured by sales, though 39% said they sometimes do.

For 68% of shoppers, seeing a huge percentage off is what makes them feel best about spending. Another 8% said they enjoy feeling like they “beat the system” and 7% said earning cash back brings them satisfaction.

“People want to feel proud about their spending,” Chatman said. “They’re realizing that a good deal isn’t just about price in this economy. It’s about timing, confidence and getting something that feels worthwhile.”

If Black Friday disappeared altogether, 55% of Americans said they’d be indifferent. Only 31% said they’d be disappointed while 13% admitted they’d feel relieved to skip the pressure.

For all its changes, Black Friday still reflects the psychology of modern spending: the balance between excitement and restraint, hype and habit. Experts say shoppers can make the most of the season by planning ahead, comparing prices over time and focusing on rewards that add long-term value rather than chasing every flash sale.

“Black Friday isn’t gone; it’s simply grown up,” Chatman said. “Today’s shopper is more strategic, less impulsive and more aware of what makes a deal truly worth it.”

To find more information, visit TopCashback.com.

Photo courtesy of Shutterstock (woman using laptop)

SOURCE:

TopCashback

Welcome to the Consumer Corner section of STM Daily News, your ultimate destination for savvy shopping and informed decision-making! Dive into a treasure trove of insights and reviews covering everything from the hottest toys that spark joy in your little ones to the latest electronic gadgets that simplify your life. Explore our comprehensive guides on stylish home furnishings, discover smart tips for buying a home or enhancing your living space with creative improvement ideas, and get the lowdown on the best cars through our detailed auto reviews. Whether you’re making a major purchase or simply seeking inspiration, the Consumer Corner is here to empower you every step of the way—unlock the keys to becoming a smarter consumer today!

https://stmdailynews.com/category/consumer-corner

Discover more from Daily News

Subscribe to get the latest posts sent to your email.