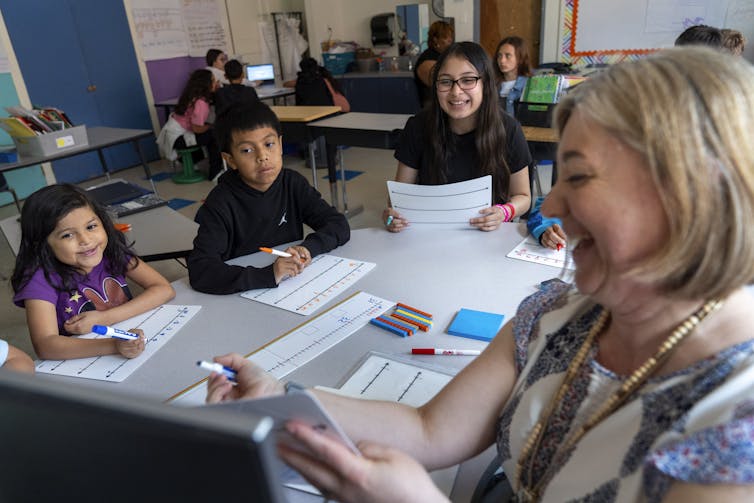

RJ Sangosti/MediaNews Group/The Denver Post via Getty Images

Girls and boys solve math problems differently – with similar short-term results but different long-term outcomes

Sarah Lubienski, Indiana University; Colleen Ganley, Florida State University, and Martha Makowski, University of Alabama

Among high school students and adults, girls and women are much more likely to use traditional, step-by-step algorithms to solve basic math problems – such as lining up numbers to add, starting with the ones place, and “carrying over” a number when needed. Boys and men are more likely to use alternative shortcuts, such as rounding both numbers, adding the rounded figures, and then adjusting to remove the rounding.

But those who use traditional methods on basic problems are less likely to solve more complex math problems correctly. These are the main findings of two studies our research team published in November 2025.

This new evidence may help explain an apparent contradiction in the existing research – girls do better at math in school, but boys do better on high-stakes math tests and are more likely to pursue math-intensive careers. Our research focuses not just on getting correct answers, but on the methods students use to arrive at them. We find that boys and girls approach math problems differently, in ways that persist into adulthood.

A possible paradox

In a 2016 study of U.S. elementary students, boys outnumbered girls 4 to 1 among the top 1% of scorers on a national math test. And over many decades, boys have been about twice as likely as girls to be among the top scorers on the SAT and AP math exams.

However, girls tend to be more diligent in elementary school and get better grades in math class throughout their schooling. And girls and boys across the grades tend to score similarly on state math tests, which tend to be more aligned with the school curriculum and have more familiar problems than the SAT or other national tests.

Beyond grades and test scores, the skills and confidence acquired in school carry far beyond, into the workforce. In lucrative STEM occupations, such as computer science and engineering, men outnumber women 3 to 1. Researchers have considered several explanations for this disparity, including differences in math confidence and occupational values, such as prioritizing helping others or making money. Our study suggests an additional factor to consider: gender differences in approaches to math problems.

When older adults think of math, they may recall memorizing times tables or doing the tedious, long-division algorithm. Memorization and rule-following can pay off on math tests focused on procedures taught in school. But rule-following has its limits and seems to provide more payoff among low-achieving than high-achieving students in classrooms.

More advanced math involves solving new, perplexing problems rather than following rules.

AP Photo/Jacquelyn Martin

Differing strategies

In looking at earlier studies of young children, our research team was struck by findings that young boys use more inventive strategies on computation problems, whereas girls more often use standard algorithms or counting. We wondered whether these differences disappear after elementary school, or whether they persist and relate to gender disparities in more advanced math outcomes.

In an earlier study, we surveyed students from two high schools with different demographic characteristics to see whether they were what we called bold problem-solvers. We asked them to rate how much they agreed or disagreed with specific statements, such as “I like to think outside the box when I solve math problems.” Boys reported bolder problem-solving tendencies than girls did. Importantly, students who reported bolder problem-solving tendencies scored higher on a math problem-solving test we administered.

Our newer studies echo those earlier results but reveal more specifics about how boys and girls, and men and women, approach basic math problems.

Algorithms and teacher-pleasing

In the first study, we gave three questions to more than 200 high school students: “25 x 9 = ___,” “600 – 498 = ___,” and “19 + 47 + 31 = ___.” Each question could be solved with a traditional algorithm or with a mental shortcut, such as solving 25 x 9 by first multiplying 25 x 8 to get 200 and then adding the final 25 to get 225.

Regardless of their gender, students were equally likely to solve these basic computation items correctly. But there was a striking gender difference in how they arrived at that answer. Girls were almost three times as likely as boys – 52% versus 18% – to use a standard algorithm on all three items. Boys were far more likely than girls – 51% versus 15% – to never use an algorithm on the questions.

We suspected that girls’ tendency to use algorithms might stem from greater social pressure toward compliance, including complying with traditional teacher expectations.

So, we also asked all the students eight questions to probe how much they try to please their teachers. We also wanted to see whether algorithm use might relate to gender differences in more advanced problem-solving, so we gave students several complex math problems from national tests, including the SAT.

As we suspected, we found that girls were more likely to report a desire to please teachers, such as by completing work as directed. Those who said they did have that desire used the standard algorithm more often.

Also, the boys in our sample scored higher than the girls on the complex math problems. Importantly, even though students who used algorithms on the basic computation items were just as likely to compute these items correctly, algorithm users did worse on the more complex math problems.

Continuing into adulthood

In our second study, we gave 810 adults just one problem: “125 + 238 = ___.” We asked them to add mentally, which we expected would discourage them from using an algorithm. Again, there was no gender difference in answering correctly.

But 69% of women, compared to 46% of men, reported using the standard algorithm for their mental calculation, rather than using another strategy entirely.

We also gave the adults a more advanced problem-solving test, this time focused on probability-related reasoning, such as the chances that rolling a seven-sided die would result in an even number. Similar to our first study, women and those who used the standard algorithm on the computation problem performed worse on the reasoning test.

The importance of inventiveness

We identified some factors that may play a role in these gender differences, including spatial-thinking skills, which may help people develop alternate calculation approaches. Anxiety about taking tests and perfectionism, both more prevalent among women, may also be a factor.

We are also interested in the power of gender-specific social pressures on girls. National data has shown that young girls exhibit more studious behavior than do boys. And the high school girls we studied were more likely than boys to report they made a specific effort to meet teachers’ expectations.

More research definitely is needed to better understand this dynamic, but we hypothesize that the expectation some girls feel to be compliant and please others may drive teacher-pleasing tendencies that result in girls using algorithms more frequently than boys, who are more socialized to be risk-takers.

While compliant behavior and standard math methods often lead to correct answers and good grades in school, we believe schools should prepare all students – regardless of gender – for when they face unfamiliar problems that require inventive problem-solving skills, whether in daily life, on high-stakes tests or in math-intensive professions.![]()

Sarah Lubienski, Professor of Mathematics Education, Indiana University; Colleen Ganley, Professor of Developmental Psychology, Florida State University, and Martha Makowski, Assistant Professor of Mathematics, University of Alabama

This article is republished from The Conversation under a Creative Commons license. Read the original article.