Economy

Understanding the Economic and Environmental Benefits of Propane School Buses

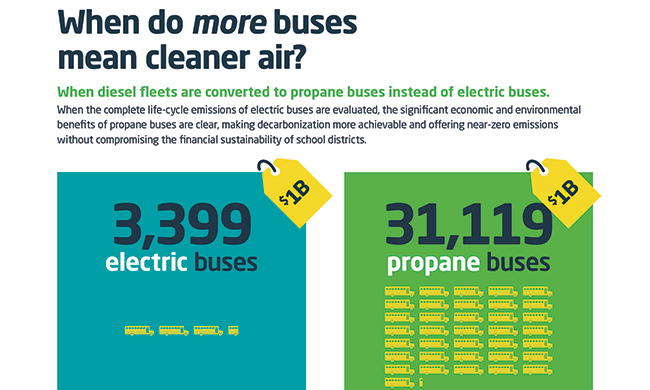

(Family Features) When diesel school bus fleets are converted to cleaner energy options – like propane – the significant economic and environmental benefits are clear, making decarbonization more achievable and offering near-zero emissions without compromising the financial sustainability of school districts. In fact, through the EPA’s Clean School Bus Program to replace existing diesel school buses with zero- and low-emission models, $1 billion would fund 31,119 propane buses. The enhanced fleet would reduce harmful nitrogen oxide emissions by 8,284 metric tons per year and carbon dioxide emissions 164,730 metric tons per year, all significant increases versus using the same amount of funding for electric school buses. Learn more at BetterOurBuses.com.

SOURCE:

Propane Education & Research Council

Our Lifestyle section on STM Daily News is a hub of inspiration and practical information, offering a range of articles that touch on various aspects of daily life. From tips on family finances to guides for maintaining health and wellness, we strive to empower our readers with knowledge and resources to enhance their lifestyles. Whether you’re seeking outdoor activity ideas, fashion trends, or travel recommendations, our lifestyle section has got you covered. Visit us today at https://stmdailynews.com/category/lifestyle/ and embark on a journey of discovery and self-improvement.

Discover more from Daily News

Subscribe to get the latest posts sent to your email.

Economy

US Consumer Confidence Fell Sharply in January: What the Latest Conference Board Data Signals

In January 2026, U.S. consumer confidence plummeted to its lowest level since 2014, as the Consumer Confidence Index fell by 9.7 points to 84.5. Concerns about inflation, employment, and economic stability led to decreased optimism across all demographics and a cautious approach to major purchases, signaling potential recession ahead.

US consumers started 2026 on a noticeably more cautious note. New data from The Conference Board shows its Consumer Confidence Index® fell sharply in January, wiping out a brief December rebound and pushing overall sentiment to its weakest level in more than a decade.

Confidence drops to the lowest level since 2014

The Conference Board Consumer Confidence Index® fell 9.7 points in January to 84.5 (1985=100), down from an upwardly revised 94.2 in December. The organization noted that December’s figure was revised up by 5.1 points, meaning what initially looked like a decline last month was actually a small uptick—before January’s slide reasserted the broader downward trend.

The cutoff for the preliminary January results was January 16, 2026.

Both “right now” and “what’s next” got worse

The decline wasn’t isolated to one part of the survey. Both consumers’ views of current conditions and their expectations for the months ahead weakened.

- Present Situation Index: down 9.9 points to 113.7

- Expectations Index: down 9.5 points to 65.1

That Expectations reading matters because it’s well below 80, a level The Conference Board says “usually signals a recession ahead.”

Dana M. Peterson, Chief Economist at The Conference Board, summed it up bluntly: confidence “collapsed” in January, with all five components deteriorating. The overall Index hit its lowest level since May 2014.

What consumers are worried about (and what’s showing up in write-ins)

The Conference Board said consumers’ write-in responses continued to skew pessimistic. The biggest themes weren’t hard to guess:

- Prices and inflation

- Oil and gas prices

- Food and grocery prices

Mentions of tariffs and trade, politics, and the labor market also rose in January. References to health/insuranceand war edged higher.

In other words: consumers aren’t just feeling uneasy—they’re pointing to specific pressure points that affect day-to-day costs and long-term stability.

Labor market perceptions softened

Consumers’ views of employment conditions weakened, with fewer respondents saying jobs are plentiful and more saying jobs are hard to get.

- 23.9% said jobs were “plentiful,” down from 27.5% in December

- 20.8% said jobs were “hard to get,” up from 19.1%

That shift matters because consumer confidence often follows the labor market. When people feel less secure about job availability, they tend to pull back on big purchases and discretionary spending.

Expectations for business conditions and jobs turned more negative

Looking six months out, pessimism increased:

- 15.6% expected business conditions to improve (down from 18.7%)

- 22.9% expected business conditions to worsen (up from 21.3%)

On jobs:

- 13.9% expected more jobs to be available (down from 17.4%)

- 28.5% anticipated fewer jobs (up from 26.0%)

Income expectations cooled too:

- 15.7% expected incomes to increase (down from 18.8%)

- 12.6% expected incomes to decline (down slightly from 13.0%)

So while fewer people expected their income to fall, the bigger story is that optimism about income growth faded.

Who’s feeling it most: age, income, and politics

On a six-month moving average basis, confidence dipped across:

- All age groups (though under 35 remained more confident than older consumers)

- All generations (with Gen Z still the most optimistic)

- All income brackets (with those earning under $15K the least optimistic)

- All political affiliations (with the sharpest decline among Independents)

This broad-based decline suggests the shift isn’t confined to one demographic pocket—it’s spreading.

Big-ticket buying plans: more “maybe,” less “yes”

The survey also pointed to increased caution around major purchases.

Consumers saying “yes” to buying big-ticket items declined in January, while “maybe” responses rose and “no” edged higher.

- Auto buying plans were flat overall, though expectations for new cars continued to falter and plans to buy used cars climbed.

- Homebuying expectations continued to retreat.

- Plans to purchase appliances, furniture, and TVs decreased.

- Electronics purchase intentions dipped in most categories—except smartphones, which continued trending upward on a six-month moving average basis.

Services spending softened—but restaurants and travel stayed interesting

Planned spending on services over the next six months weakened in January, with fewer consumers saying “yes” and more shifting into “maybe.”

Still, a few categories stood out:

- Restaurants, bars, and take-out remained the top planned services spending category and continued to rise.

- Consumers also intended to spend more on hotels/motels for personal travel, airfare/trains, and motor vehicle services.

The Conference Board noted this was surprising given the plunge in vacation plans—especially for domestic travel—also recorded in the survey.

What to watch next

January’s report paints a clear picture: consumers are feeling squeezed by costs, less confident about the labor market, and more hesitant about major purchases. The Expectations Index dropping deeper below the “recession signal” threshold will likely keep economists, businesses, and policymakers watching the next few releases closely.

The Conference Board publishes the Consumer Confidence Index® at 10 a.m. ET on the last Tuesday of every month.

Source: The Conference Board, January 2026 Consumer Confidence Survey® (PRNewswire release, Jan. 27, 2026).

Discover more from Daily News

Subscribe to get the latest posts sent to your email.

Economy

Allegiant and Sun Country Airlines to Combine: A Bigger, More Competitive Leisure Airline Takes Shape

Allegiant and Sun Country announced a merger that would create a larger leisure-focused airline serving 22 million customers, nearly 175 cities, and 650+ routes—plus expanded international access and loyalty benefits.

Allegiant and Sun Country Airlines are planning to merge in a deal that would create one of the most significant leisure-focused airline platforms in the United States—one built around flexible capacity, underserved markets, and price-sensitive travelers.

Announced January 11, 2026, the definitive merger agreement calls for Allegiant (NASDAQ: ALGT) to acquire Sun Country (NASDAQ: SNCY) in a cash-and-stock transaction valued at an implied $18.89 per Sun Country share. If approved by regulators and shareholders, the combined company would serve roughly 22 million annual customers, fly to nearly 175 cities, operate 650+ routes, and manage a fleet of about 195 aircraft.

For travelers, the headline is simple: more leisure routes, more destination options, and a larger loyalty ecosystem. For the economy—especially in regions that rely on affordable air access—the bigger story is how consolidation among niche carriers could reshape competition, connectivity, and regional tourism.

Deal snapshot: how the merger is structured

Under the agreement, Sun Country shareholders would receive 0.1557 shares of Allegiant common stock plus $4.10 in cash for each Sun Country share. The offer represents a 19.8% premium over Sun Country’s closing price on January 9, 2026, according to the companies.

The transaction values Sun Country at approximately $1.5 billion, including $0.4 billion of net debt. After closing, Allegiant shareholders would own about 67% of the combined company, with Sun Country shareholders owning about 33% on a fully diluted basis.

The companies expect the deal to close in the second half of 2026, pending federal antitrust clearance, other regulatory approvals, and shareholder votes.

Why this combination matters in the leisure travel market

Allegiant and Sun Country are both known for leisure-first strategies, but they’ve historically approached the market from different angles:

- Allegiant has built its brand around connecting small and mid-sized cities to vacation destinations—often with nonstop, limited-frequency routes designed to match demand.

- Sun Country has operated more like a hybrid low-cost carrier, balancing scheduled passenger service with charter flying and a major cargo business.

In the press release, Allegiant CEO Gregory C. Anderson framed the merger as a natural fit between two “flexible” models designed to adjust quickly to demand. Sun Country CEO Jude Bricker emphasized the airline’s Minnesota roots and its diversified approach across passenger, charter, and cargo.

In a travel economy where consumer demand can swing quickly—fuel prices, inflation, seasonal travel surges, and shifting vacation trends all matter—flexibility is a competitive advantage. This merger is essentially a bet that scale plus adaptability can outperform traditional network strategies in the leisure segment.

What travelers could see: routes, destinations, and loyalty upgrades

The companies are pitching the merger as a way to expand choice without changing how customers book in the short term.

More routes and more nonstop options

The combined network would include 650+ routes, including 551 Allegiant routes and 105 Sun Country routes. The idea is that the two networks complement each other: Allegiant’s smaller-market footprint plus Sun Country’s strength in larger cities.

One specific promise: the merger would connect Minneapolis–St. Paul (MSP) more directly to Allegiant’s mid-sized markets, while also expanding service to popular vacation destinations.

Expanded international reach

Sun Country’s existing international network would give Allegiant customers access to 18 international destinationsacross Mexico, Central America, Canada, and the Caribbean.

For leisure travelers, that’s a meaningful shift—especially for customers in smaller cities who may currently need multiple connections (or higher fares) to reach international vacation spots.

A bigger loyalty program

The companies say the combined loyalty program would be larger and more flexible, adding Sun Country’s 2+ million members to Allegiant’s 21 million member base.

In practical terms, travelers should expect more ways to earn and redeem rewards—though the real value will depend on how the programs are integrated and what benefits survive the merger.

The economic angle: competition, regional access, and tourism dollars

This announcement lands in a broader conversation about airline consolidation and what it means for consumers and communities.

On one hand, a larger leisure-focused airline could:

- Increase air service options in underserved markets

- Improve seasonal connectivity to tourism hubs

- Support local economies that depend on visitor spending

On the other hand, consolidation can also raise concerns about:

- Reduced competition on certain routes

- Pricing power in smaller markets

- Fewer independent carriers fighting for leisure travelers

The companies argue the merger will create a “more competitive” leisure airline, not less. That claim will likely be tested during antitrust review—especially on routes where Allegiant and Sun Country overlap or where one carrier’s presence is a key source of low fares.

Cargo and charter: the less flashy, more stabilizing part of the deal

One of the most important (and most overlooked) parts of this merger is the emphasis on diversified operations.

Sun Country brings a major cargo business, including a multi-year agreement with Amazon Prime Air, plus charter contracts with casinos, Major League Soccer, collegiate sports teams, and the Department of Defense. Allegiant also has an existing charter business.

From an economic standpoint, these contract-driven revenue streams matter because they can:

- Smooth out seasonal swings in leisure demand

- Improve aircraft and crew utilization year-round

- Reduce exposure to consumer travel slowdowns

If the combined company can balance leisure flying with cargo and charter commitments, it may be better positioned to maintain service levels—even when discretionary travel dips.

Financial expectations: synergies, EPS, and fleet scale

Allegiant expects the merger to generate $140 million in annual synergies by year three after closing. The deal is also expected to be accretive to earnings per share (EPS) in year one post-closing.

The combined airline would operate about 195 aircraft, with 30 on order and 80 additional options. The companies also highlight the benefit of operating both Airbus and Boeing aircraft, and the ability to better utilize Allegiant’s 737 MAX fleet and order book.

For investors, the message is scale plus efficiency. For travelers and local economies, the question is whether those efficiencies translate into more routes, better reliability, and sustained low fares.

What happens next: timeline and what won’t change immediately

Even if the deal closes, Allegiant says both airlines will operate separately until they receive a single operating certificate from the FAA.

That means:

- No immediate changes to ticketing or schedules

- No immediate changes to the Sun Country brand

- Customers can continue booking and flying as they do today

The combined company would remain headquartered in Las Vegas, while maintaining a “significant presence” in Minneapolis–St. Paul.

Bottom line

If approved, the Allegiant–Sun Country merger would create a scaled leisure airline with a broader route map, expanded international access, and a loyalty program that reaches tens of millions of travelers.

For the U.S. travel economy, the deal is also a signal: the leisure segment—once treated like a niche—is becoming a battleground where scale, flexibility, and diversified revenue (cargo and charter) could define the next era of competition.

As regulators review the merger and the companies move toward a second-half 2026 closing, travelers and communities will be watching for the real-world impact: more service, more destinations, and whether “affordable leisure travel” stays affordable.

Quick facts (from the announcement)

- Deal announced: January 11, 2026

- Structure: cash + stock

- Implied value per Sun Country share: $18.89

- Premium: 19.8% over Jan. 9, 2026 close

- Combined scale: 22M annual customers, ~175 cities, 650+ routes, ~195 aircraft

- Expected synergies: $140M annually by year 3 post-close

- Expected close: second half of 2026 (subject to approvals)

For readers tracking the business side: Allegiant and Sun Country scheduled an investor conference call for Monday, January 12, 2026, at 8:30 a.m. Eastern Time, with a webcast posted via Allegiant’s investor relations site.

Related Links

- Allegiant Investor Relations (conference call/webcast info)

- SoaringForLeisure.com (transaction website)

- Allegiant SEC Filings

- Sun Country SEC Filings

SOURCE Allegiant Travel Company

Stay with STM Daily News: We’ll keep tracking this story as it develops—regulatory approvals, route updates, loyalty program changes, and what it could mean for travelers and the broader U.S. travel economy. For the latest coverage, visit https://stmdailynews.com.

Discover more from Daily News

Subscribe to get the latest posts sent to your email.

News

Major Popeyes Franchisee Sailormen Files for Chapter 11 — What It Means for Restaurants and the Economy

Sailormen Inc., a major Popeyes franchisee operating 130+ locations in Florida and Georgia, filed for Chapter 11 on Jan. 15, 2026 amid rising costs and heavy debt. Many restaurants are expected to remain open as restructuring continues.

A major Popeyes Louisiana Kitchen franchise operator is heading to bankruptcy court — but the headline does notmean Popeyes corporate is filing, or that every restaurant involved is about to close.

Sailormen Inc., a Miami-based Popeyes franchisee that has operated in the system since 1987, filed for Chapter 11 bankruptcy protection on Jan. 15, 2026. The company operates more than 130 Popeyes locations across Florida and Georgia (some industry coverage puts the count at 136), making it one of the chain’s largest franchise groups in the region.

Franchisee filing, not a Popeyes corporate bankruptcy

This case involves Sailormen (the operator) — not Popeyes corporate and not parent company Restaurant Brands International.

In a message referenced in industry reporting, Popeyes leadership said Sailormen’s filing does not reflect the overall health of the Popeyes brand, and that a large majority of Sailormen’s restaurants are expected to remain open while the company restructures.

What pushed Sailormen into Chapter 11

Court-related summaries and industry coverage point to a familiar mix of pressures hitting restaurant operators:

- Inflation and higher operating costs (food, labor, and day-to-day expenses)

- Higher borrowing costs as interest rates climbed

- Liquidity strain, including reports of falling behind on rent and facing pressure from landlords and vendors

- Legal disputes, including vendor-related claims tied to unpaid balances

The failed store sale that worsened the situation

One key detail: Sailormen reportedly tried to sell 16 Georgia restaurants to stabilize finances. That deal fell through, and the company remained responsible for lease guarantees tied to those locations — a liability that can linger even if other stores are performing.

The debt and the lender pressure

Industry reporting describes Sailormen as carrying a heavy debt load — cited at about $130 million overall.

More detailed figures cited in coverage include:

- Over $112 million in unpaid principal loan balance

- Over $17 million in accrued interest and fees

Reporting also points to pressure from BMO (BMO Bank), described as Sailormen’s largest lender. In December 2025, BMO reportedly sought to appoint a receiver, a move that can displace management and take control of a company’s assets. Sailormen’s Chapter 11 filing allows the company to continue operating as a debtor-in-possession while it attempts to reorganize.

Why this matters for “Food” and “Our Economy”

This isn’t just a Popeyes story — it’s a snapshot of what happens when restaurant operators face higher costs, value-conscious consumers, and more expensive debt at the same time.

Chapter 11 is designed to reorganize a business, not automatically liquidate it. For customers, the near-term impact may be limited if most locations stay open.

STM Daily News will follow this story as it develops, including any updates on store operations, restructuring plans, and potential sales of locations.

Sources

- Restaurant Business: “A big Popeyes franchisee files for bankruptcy” https://restaurantbusinessonline.com/financing/big-popeyes-franchisee-files-bankruptcy

- Restaurant Dive: “Large Popeyes franchisee files for Chapter 11” https://www.restaurantdive.com/news/popeyes-frachisee-sailormen-files-chapter-11-bankruptcy-protections/809854/

For more food business headlines and how they connect to the real economy, follow STM Daily News.

Discover more from Daily News

Subscribe to get the latest posts sent to your email.