financial wellness

Financial Literacy 101

Financial Wellness

(Family Features) Financial anxiety is on the rise in the United States, making financial literacy – simply put, the ability to understand and effectively utilize various money management practices including budgeting, investing and saving among others – as important as ever.

In fact, 36% of the U.S. general population feel anxious about their current financial situations with 26% feeling strained, according to research from World Financial Group. Taking steps to become more financially literate and manage money more effectively can help.

While there isn’t one “right” way to gain financial literacy, these steps can help grow your understanding and confidence around your finances.

- Understand Your Finances

Understanding your finances and how your financial decisions impact your future self is essential for making appropriate choices. Without this understanding of your income and expenses, you become vulnerable to making the wrong decisions and can put yourself at greater risk in the future.

To further expand your knowledge base, consider taking a financial literacy quiz to test your understanding of concepts such as compounding interest, inflation and risk diversification. If necessary, don’t be afraid to seek the advice of a professional before making important financial decisions. - Take Control and Plan with Confidence

To take control of short- and long-term financial priorities and aspirations, individuals should plan ahead. Establishing these goals is the first step to effective planning, whether lifestyle goals, hopes for retirement or specific items you wish to acquire, such as a new vehicle or home. This approach provides a target for building your savings and protection plans. - Prepare and Plan for Life’s Unexpected Events

If not adequately prepared, unexpected events can have catastrophic impacts on household finances. For example, having to leave the workforce early due to illness could mean years of lost earning power, which could impact your short- and long-term priorities and aspirations. Therefore, it’s essential to ensure backup plans, such as a retirement account or life insurance that includes income protection if unable to work, are in place, if the unexpected happens. This “cushion” can contribute to greater confidence in your future financial outlook and stronger feelings of security going into waves of economic uncertainty.

Test your literacy to assess your understanding and confidence around finances at WorldFinancialGroup.com.

Photo courtesy of iStock

SOURCE:

World Financial Group

Our Lifestyle section on STM Daily News is a hub of inspiration and practical information, offering a range of articles that touch on various aspects of daily life. From tips on family finances to guides for maintaining health and wellness, we strive to empower our readers with knowledge and resources to enhance their lifestyles. Whether you’re seeking outdoor activity ideas, fashion trends, or travel recommendations, our lifestyle section has got you covered. Visit us today at https://stmdailynews.com/category/lifestyle/ and embark on a journey of discovery and self-improvement.

Discover more from Daily News

Subscribe to get the latest posts sent to your email.

Family

Holiday Must-Haves: Make holiday shopping a cinch

There’s nothing quite like the joy of watching a loved one’s face light up when opening a gift you selected with care, but holiday shopping can be a chore.

Last Updated on November 28, 2025 by Daily News Staff

(Family Features) There’s nothing quite like the joy of watching a loved one’s face light up when opening a gift you selected with care, but holiday shopping can be a chore.

If you’re a shopper at heart, it may be a challenge you enjoy, but if the idea of holiday shopping brings out the Grinch in you, consider these ideas for gifts to delight those you love this holiday season.

Look for more ideas to make this holiday season magical at eLivingtoday.com.

Power Up Your Holidays with Protein

Whether you’re out shopping or traveling for the holiday, savor the season without compromising health goals by treating yourself to a Premier Protein Winter Mint Chocolate High Protein Shake. Featuring cozy chocolate and refreshing mint flavors, this seasonal favorite is back, but for a limited time only. Flavorful and packed with the nutrition you need, each shake includes 30 grams of protein, 160 calories and 1 gram of sugar. Whether you drink this shake on its own or use it as an ingredient, you can ring in the season with a healthy amount of vitamins C and E, important antioxidants to support a healthy immune system as part of a healthy diet and lifestyle. Learn more at PremierProtein.com.

Holiday Sweets for a Good Cause

Few things go together like the holiday season and sweet treats. By gifting family and friends Wendy’s Frosty Key Tags, which are good for a free Jr. Frosty with every purchase, you can give back all year long because proceeds from every tag sold helps the Dave Thomas Foundation for Adoption find loving, adoptive homes for children in foster care. Available for purchase every November and December, tags are good for one full year and can be purchased in-restaurant, at the drive-thru, via a kiosk, through the app or at Wendys.com.

Step Up Gifting with Fashion-Forward Footwear

Every fashionista knows there’s no such thing as too many shoes, and that includes ankle boots and booties that never go out of style. These low-slung styles can be dressed up or down, depending on the look you’re wearing. Among this season’s hottest designs are faux animal prints, such as cheetah or snakeskin, that add some playful color and texture to complete an ensemble. If you’re not sure about the color or style, a classic black or brown bootie with well-padded soles and a moderate heel is a versatile choice with universal appeal.

Brrr-ing Gifts of Warmth and Good Cheer

Give loved ones an easy way to brighten a cold, dreary day with a cute and cozy matching hat and glove set. It’s a thoughtful and practical gift that brings a smile to recipients’ faces each time they don those warm layers to face a blustery day. What’s more, with all the options for personalization, it’s an affordable way to show you care. When choosing the perfect duo, keep your loved ones’ tastes and preferences in mind. You can find hats and gloves to match virtually any interest, whether it’s a favorite color, sports team or pop culture reference.

Holiday Shopping Hot List

Turns out, Santa may be onto something. Making your list and checking it twice can help you save money (and your sanity) during the holiday season.

- Set a budget and stick to it. Remember to include all your seasonal expenses, including Secret Santa and teacher gifts, ingredients for dishes you’ll take to potluck gatherings and admission to special holiday activities.

- Make a list. Having an idea of what you’d like to buy can help you stick to your budget and avoid frustration when you’re in the stores. You’ll be more likely to avoid costly impulse purchases and you’ll be more efficient while shopping. If you can, jot down a couple of backup ideas just in case what you want proves hard to find or exceeds your budget.

- Shop for deals. Before you head out shopping, research specials on the items on your list. You may be able to adjust your timing to take advantage of sales or find steep discounts at stores you don’t normally visit.

- Give yourself plenty of time. If holiday shopping stresses you out, it’s a good idea to start early. That way you can tackle a little at a time and avoid feeling the pressure of a ticking clock. Also try shopping during off-peak hours, such as during the week, when stores are likely to be less crowded.

- Map out your plan of attack. Planning the most direct route to travel from one retailer to the next can help keep you organized and avoid unnecessary backtracking. You can also save time and gas by making purchases online. Be sure to watch for promotions that provide free shipping and be conscious of shipping times to ensure gifts arrive in time for the big day.

Photo courtesy of Getty Images (couple with gifts)

Photos courtesy of Unsplash (boots and hats)

SOURCE:

Premier Protein

Wendy’s

Discover more from Daily News

Subscribe to get the latest posts sent to your email.

Family

Holiday Must-Haves: Make holiday shopping a cinch

There’s nothing quite like the joy of watching a loved one’s face light up when opening a gift you selected with care, but holiday shopping can be a chore.

Last Updated on November 26, 2025 by Daily News Staff

(Family Features) There’s nothing quite like the joy of watching a loved one’s face light up when opening a gift you selected with care, but holiday shopping can be a chore.

If you’re a shopper at heart, it may be a challenge you enjoy, but if the idea of holiday shopping brings out the Grinch in you, consider these ideas for gifts to delight those you love this holiday season.

Look for more ideas to make this holiday season magical at eLivingtoday.com.

Power Up Your Holidays with Protein

Whether you’re out shopping or traveling for the holiday, savor the season without compromising health goals by treating yourself to a Premier Protein Winter Mint Chocolate High Protein Shake. Featuring cozy chocolate and refreshing mint flavors, this seasonal favorite is back, but for a limited time only. Flavorful and packed with the nutrition you need, each shake includes 30 grams of protein, 160 calories and 1 gram of sugar. Whether you drink this shake on its own or use it as an ingredient, you can ring in the season with a healthy amount of vitamins C and E, important antioxidants to support a healthy immune system as part of a healthy diet and lifestyle. Learn more at PremierProtein.com.

Holiday Sweets for a Good Cause

Few things go together like the holiday season and sweet treats. By gifting family and friends Wendy’s Frosty Key Tags, which are good for a free Jr. Frosty with every purchase, you can give back all year long because proceeds from every tag sold helps the Dave Thomas Foundation for Adoption find loving, adoptive homes for children in foster care. Available for purchase every November and December, tags are good for one full year and can be purchased in-restaurant, at the drive-thru, via a kiosk, through the app or at Wendys.com.

Step Up Gifting with Fashion-Forward Footwear

Every fashionista knows there’s no such thing as too many shoes, and that includes ankle boots and booties that never go out of style. These low-slung styles can be dressed up or down, depending on the look you’re wearing. Among this season’s hottest designs are faux animal prints, such as cheetah or snakeskin, that add some playful color and texture to complete an ensemble. If you’re not sure about the color or style, a classic black or brown bootie with well-padded soles and a moderate heel is a versatile choice with universal appeal.

Brrr-ing Gifts of Warmth and Good Cheer

Give loved ones an easy way to brighten a cold, dreary day with a cute and cozy matching hat and glove set. It’s a thoughtful and practical gift that brings a smile to recipients’ faces each time they don those warm layers to face a blustery day. What’s more, with all the options for personalization, it’s an affordable way to show you care. When choosing the perfect duo, keep your loved ones’ tastes and preferences in mind. You can find hats and gloves to match virtually any interest, whether it’s a favorite color, sports team or pop culture reference.

Holiday Shopping Hot List

Turns out, Santa may be onto something. Making your list and checking it twice can help you save money (and your sanity) during the holiday season.

- Set a budget and stick to it. Remember to include all your seasonal expenses, including Secret Santa and teacher gifts, ingredients for dishes you’ll take to potluck gatherings and admission to special holiday activities.

- Make a list. Having an idea of what you’d like to buy can help you stick to your budget and avoid frustration when you’re in the stores. You’ll be more likely to avoid costly impulse purchases and you’ll be more efficient while shopping. If you can, jot down a couple of backup ideas just in case what you want proves hard to find or exceeds your budget.

- Shop for deals. Before you head out shopping, research specials on the items on your list. You may be able to adjust your timing to take advantage of sales or find steep discounts at stores you don’t normally visit.

- Give yourself plenty of time. If holiday shopping stresses you out, it’s a good idea to start early. That way you can tackle a little at a time and avoid feeling the pressure of a ticking clock. Also try shopping during off-peak hours, such as during the week, when stores are likely to be less crowded.

- Map out your plan of attack. Planning the most direct route to travel from one retailer to the next can help keep you organized and avoid unnecessary backtracking. You can also save time and gas by making purchases online. Be sure to watch for promotions that provide free shipping and be conscious of shipping times to ensure gifts arrive in time for the big day.

Photo courtesy of Getty Images (couple with gifts)

Photos courtesy of Unsplash (boots and hats)

SOURCE:

Premier Protein

Wendy’s

Discover more from Daily News

Subscribe to get the latest posts sent to your email.

Consumer Corner

Black Friday Redefined: A month-long ritual of planning, patience and price-checking

Last Updated on November 21, 2025 by Daily News Staff

(Family Features) Once a one-day shopping extravaganza defined by long lines and doorbuster deals, Black Friday has transformed into a season of rolling discounts and fading excitement.

Black Friday Redefined: A month-long ritual of planning, patience and price-checking

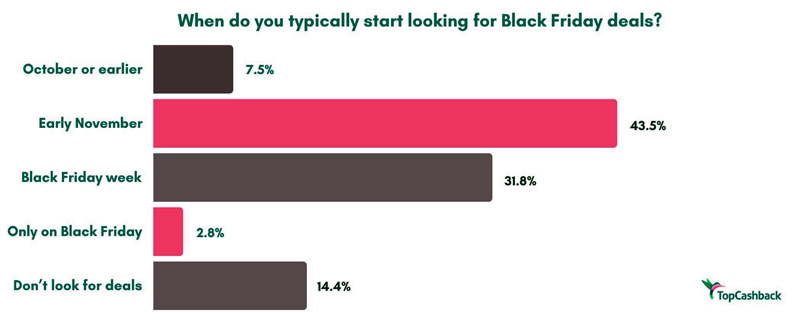

According to new research from TopCashback, nearly 7 in 10 Americans no longer consider Black Friday a one-day event, viewing it instead as a month-long shopping season. Only about one-third still see it as a single-day tradition. More than half of respondents said they now shop online instead of in stores, and 43% start scouting deals in early November.

Findings suggest Black Friday’s sense of urgency has shifted, replaced by a steady flow of rolling discounts and digital promotions. What was once a race for the best bargains has become a marathon for savings.

The evolution of Black Friday appears to be changing how people spend, too. While 18% of shoppers said they spend less now than they did five years ago, another 18% said their habits haven’t changed much. Only 3% reported spending more. For many, the shift seems to be less about budget and more about timing.

Asked whether they’d prefer Black Friday return to a single-day event, 44% said they like having more time to shop, while 26% said a one-day version would feel “less overwhelming.” The rest simply don’t mind either way.

“Consumers are rethinking how they approach major sales events,” said Destiny Chatman, consumer analyst at TopCashback. “They still want value, but they’re less willing to be rushed. The new Black Friday is about planning, timing and feeling in control of spending.”

The research also found shoppers are increasingly aware of the marketing tactics behind the hype. Two-thirds said they believe brands create fake urgency around Black Friday, and another 30% said they think it happens “sometimes.” Despite the skepticism, most still admit deep discounts drive their decisions – nearly 87% said upfront savings are their top motivator, compared with just 6% who said they’re most influenced by cash back or rewards.

Still, money-back incentives aren’t without impact. Four in 10 respondents said they’ve made a purchase specifically because cash back was offered, and about half said they’d consider choosing a smaller discount if it came with meaningful rewards. Electronics and tech ranked as the top categories where shoppers expect to earn the most cash back, followed by fashion and beauty.

Even with the season stretching longer, the emotional rollercoaster of Black Friday remains. Most respondents said they feel neutral after shopping while 33% said they feel proud of the deals they scored. Smaller groups reported guilt or regret after their purchases.

Impulse buying persists with more than 62% saying they occasionally buy things they didn’t plan to, and nearly 1 in 5 said it happens most years. Still, only 5% said they always feel pressured by sales, though 39% said they sometimes do.

For 68% of shoppers, seeing a huge percentage off is what makes them feel best about spending. Another 8% said they enjoy feeling like they “beat the system” and 7% said earning cash back brings them satisfaction.

“People want to feel proud about their spending,” Chatman said. “They’re realizing that a good deal isn’t just about price in this economy. It’s about timing, confidence and getting something that feels worthwhile.”

If Black Friday disappeared altogether, 55% of Americans said they’d be indifferent. Only 31% said they’d be disappointed while 13% admitted they’d feel relieved to skip the pressure.

For all its changes, Black Friday still reflects the psychology of modern spending: the balance between excitement and restraint, hype and habit. Experts say shoppers can make the most of the season by planning ahead, comparing prices over time and focusing on rewards that add long-term value rather than chasing every flash sale.

“Black Friday isn’t gone; it’s simply grown up,” Chatman said. “Today’s shopper is more strategic, less impulsive and more aware of what makes a deal truly worth it.”

To find more information, visit TopCashback.com.

Photo courtesy of Shutterstock (woman using laptop)

SOURCE:

TopCashback

Welcome to the Consumer Corner section of STM Daily News, your ultimate destination for savvy shopping and informed decision-making! Dive into a treasure trove of insights and reviews covering everything from the hottest toys that spark joy in your little ones to the latest electronic gadgets that simplify your life. Explore our comprehensive guides on stylish home furnishings, discover smart tips for buying a home or enhancing your living space with creative improvement ideas, and get the lowdown on the best cars through our detailed auto reviews. Whether you’re making a major purchase or simply seeking inspiration, the Consumer Corner is here to empower you every step of the way—unlock the keys to becoming a smarter consumer today!

https://stmdailynews.com/category/consumer-corner

Discover more from Daily News

Subscribe to get the latest posts sent to your email.